GBP Bond Idea

Prudential PLC 5.00% 07/20/2055

Price: 99.00

Yield to call: 5.05%

Call date: 20July 2035

Coupon reset: UK Govt bond 5 years bid yield (currently at 0.306%) + 3.600%

Advance Margin: 60%

Currency: GBP

Price: 99.00

Yield to call: 5.05%

Call date: 20July 2035

Coupon reset: UK Govt bond 5 years bid yield (currently at 0.306%) + 3.600%

Advance Margin: 60%

Currency: GBP

Prudential PLC is an ideal bond issuer:

Large cap global insurance company

Relatively low debt to equity

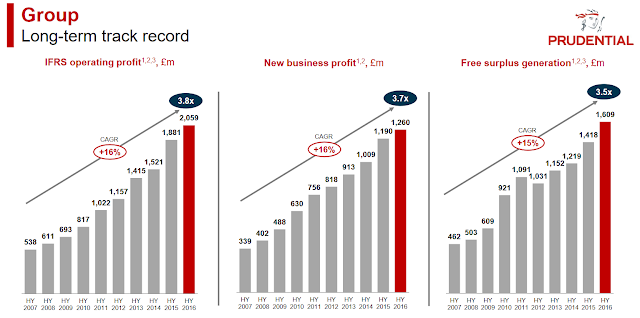

Rising earnings trend

Generates healthy free cashflow

Relatively low debt to equity

Rising earnings trend

Generates healthy free cashflow

To make money from strong issuer, bond investors have to take duration risk (by buying bonds with longer maturity).

Comments from Moody's after Brexit on Prudential PLC bond:

"Moody's has affirmed Prudential Plc's debt ratings with a stable outlook. This reflects Prudential's excellent product and geographic diversification, with significant exposure to the Asian and US markets, which reduces its reliance on the UK life insurance market. At YE2015, around 25% of Prudential Plc's operating profit was generated from its UK life business."

Comments

Post a Comment